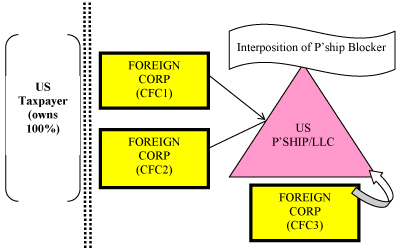

The IRS and the Treasury Department are aware of a type of transaction that in which a US taxpayer that owns CFCs that hold stock of a lower-tier CFC through a domestic partnership takes the position that subpart F income of the lower-tier CFC (or an amount determined under Section 956(a) related to holdings of US property by the lower tier CFC) does not result in income inclusion under Section 951(a) for the US taxpayer. The IRS and the Treasury Department believe that this transaction has the potential for tax avoidance or evasion, but lack sufficient information to determine whether the transaction should be “listed” (i.e., as a tax avoidance transaction).