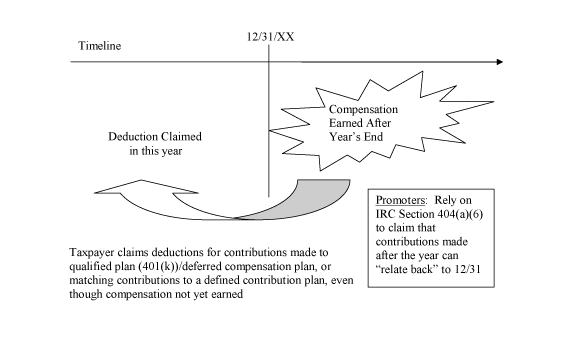

Backdating Plan Contributions Attributable to

Compensation Earned After Year’s End

IRS Rev. Ruling 90-105

Variation:

Variation:

IRS Rev. Ruling 2002-46 (principle applies regardless of whether the employer’s liability to make the minimum contribution is fixed before the close of that taxable year)

If you believe that you may have engaged in a transaction that is the same or substantially similar to the transaction described above, Federal law may require you to disclose your and other parties’ participation in any such “listed transaction” on IRS Form 8886. For more information about Federal law requirements, please contact us.

T. Scott Tufts, Esq., Copyright, All Rights Reserved,